A home equity line of credit (HELOC) allows homeowners to borrow against their property’s value. While flexibility is a primary benefit, understanding how interest rates function is vital before opening a line of credit. These rates directly impact your monthly payments, total borrowing costs, and long-term financial health. This article explores how interest rates are determined for home equity credit, the factors that influence them, and how borrowers can manage this financial tool effectively.

- What is home equity credit?

- Variable interest rates explained

- Why interest rates change

- How rates affect monthly payments

- Comparing interest-only and repayment phases

- Factors that influence your specific rate

- Why comparing rates matters

- Managing interest rate risk

- Planning ahead for long-term success

- Conclusion

What is home equity credit?

Home equity credit lets homeowners borrow against their property’s equity, the difference between the home’s current value and the outstanding mortgage balance. It functions as a revolving line of credit, unlike a traditional lump-sum loan. Borrowers can draw funds as needed during a set period and repay only what they use. This makes it a flexible option for ongoing expenses like renovations or unexpected costs. Interest is charged on the borrowed amount, not the entire credit limit.

Variable interest rates explained

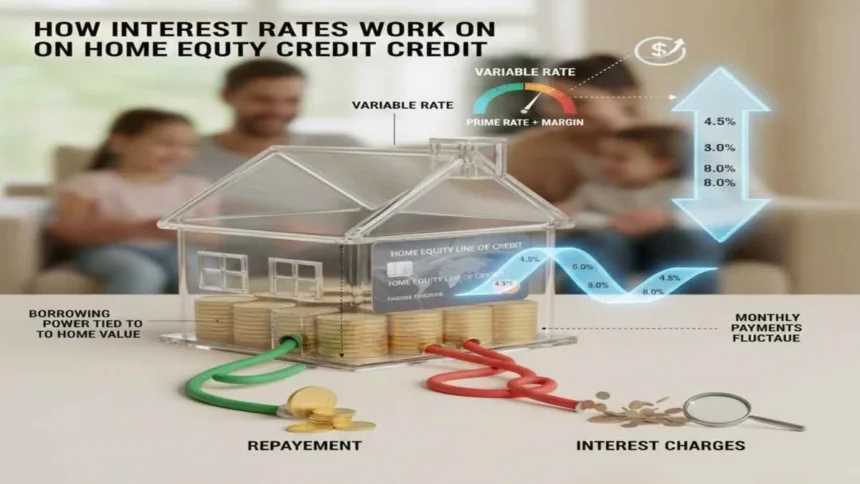

Most home equity credit products use variable interest rates. This means the rate can change over time, usually based on broader economic indicators.

A variable rate typically includes:

- A base rate tied to market conditions

- A margin added by the lender

When market rates change, the credit line’s interest rate adjusts, affecting monthly payments and overall costs. Understanding this is key to managing financial expectations.

Why interest rates change

Several factors influence the interest rates on home equity credit, including inflation, economic growth, and monetary policy. As the economy shifts, interest rates tend to follow suit. If rates rise, your monthly payments might increase even if your borrowing habits don’t change. Conversely, when rates fall, borrowing becomes more affordable. Since these fluctuations are beyond your control, it’s wise to be prepared and flexible when using home equity credit.

How rates affect monthly payments

Fluctuating interest rates directly impact your monthly payments. Even a slight increase can significantly raise costs over time, particularly for those with larger balances. During the draw period, you might only pay the interest, which keeps initial costs low. However, once the repayment phase begins, your payments will rise as you start paying back both the principal and interest. Planning for these shifts early can help you avoid future financial strain.

Comparing interest-only and repayment phases

Draw period costs

During the draw period, borrowers can access funds while typically making interest-only payments. This keeps monthly payments low but does not reduce the principal balance. While this phase provides flexibility, careful management is essential to prevent balances from growing quickly.

Repayment period costs

After the draw period ends, the repayment phase begins. Monthly payments will increase as you start paying down the principal in addition to interest. Knowing exactly when this transition occurs allows you to adjust your budget in advance and prepare for these higher costs.

Factors that influence your specific rate

While market conditions play a major role, individual financial factors also affect interest rates on home equity credit. These include:

- Credit score and credit history

- Debt-to-income ratio

- Loan-to-value ratio

- Payment history

Stronger financial profiles often qualify for lower margins, reducing the overall credit line interest rate. Since housing values and equity levels vary by region, these factors can significantly impact outcomes.

Why comparing rates matters

Interest rates directly influence the long-term cost of borrowing, and even minor differences can lead to significant savings or expenses over time. When reviewing home equity line of credit rates in Utah, it’s crucial to look beyond the initial number. Homeowners should understand the full rate structure, including how variable rates might affect future payments. Comparing how rates adjust, not just where they start, provides a clearer picture of the loan’s long-term financial impact and leads to better decisions.

Managing interest rate risk

Because variable rates can rise, managing risk is an important part of using home equity credit responsibly.

Helpful strategies include:

- Borrowing only what is needed

- Paying more than the minimum when possible

- Maintaining an emergency fund

- Monitoring rate changes regularly

These habits can reduce exposure to rising rates and keep debt manageable.

Planning ahead for long-term success

Home equity credit is most effective with careful planning. Understanding how interest rates work helps borrowers stay prepared for changes rather than reacting to them. For many homeowners, their property is a key financial asset. Using home equity wisely can address short-term needs while supporting long-term goals. Clear planning, awareness, and realistic budgeting ensure a solid foundation for success.

Conclusion

Interest rates determine the true cost of home equity credit. By understanding how they function and why they shift, you can make more informed financial decisions. With proactive planning, home equity credit becomes a versatile tool rather than a source of stress. Using it thoughtfully allows you to leverage your home’s value while protecting your financial future.